does indiana have a inheritance tax

At this point there are only six states that impose state-level inheritance taxes. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

Indiana Income Tax Calculator Smartasset

For individuals dying before January 1 2013.

. An estate worth less than 50000 will not need to go through probate. The amount can be doubled for a married couple with properly drafted Wills or Trusts. As a result Indiana residents will not owe any Indiana state tax after this date.

Indiana is one of 38 states in the nation that does not have an estate tax. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. However be sure you remember to file the following.

Even though indiana does not collect an inheritance tax however. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. There is no federal inheritance tax and only six states levy the tax. Indiana inheritance tax was eliminated as of January 1 2013.

You only have to pay US inheritance tax if the deceased was a US resident citizen or green card holder. Twelve states and Washington DC. Indianas inheritance tax still applies.

The Inheritance tax was repealed. 0 percent on transfers to a. For those who do not plan the amount of Federal Estate Tax that will be required to be paid can.

States have typically thought of these taxes as a way to increase their revenues. However other states inheritance laws may apply to you if. There is no inheritance tax in Indiana either.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. How Much Is Inheritance Tax. Indiana repealed the inheritance tax in 2013.

However many states realize that citizens. In general estates or beneficiaries of. Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar.

Indiana does not have an inheritance tax nor does it have a gift tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Indianas inheritance tax still applies.

No inheritance tax has to be paid for individuals dying after December 31 2012. Although the State of. Here in Indiana we did have an inheritance.

Transferring Inheritance Money To The US. Are required to file an inheritance tax return. No tax has to be paid.

Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent.

Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. On the federal level there is no inheritance tax. Therefore no inheritance tax returns must be filed at this time.

Indiana repealed the inheritance tax in 2013. However youll still have to.

Indiana Estate Planning Elder Law Gift Tax

Indiana Lawmakers Discuss Trigger For Income Tax Cuts

Gov Daniels Signs Indiana Inheritance Tax Phase Out Bill Wthr Com

Inheritance Laws Explained When To Pay Taxes

What To Do Once You Ve Received An Inheritance Thk Law Llp

Inheritance Laws Explained When To Pay Taxes

Tax Burden By State For Retirees And Seniors Seniorliving Org

Center For State Tax Policy Tax Foundation

Calculating Inheritance Tax Laws Com

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

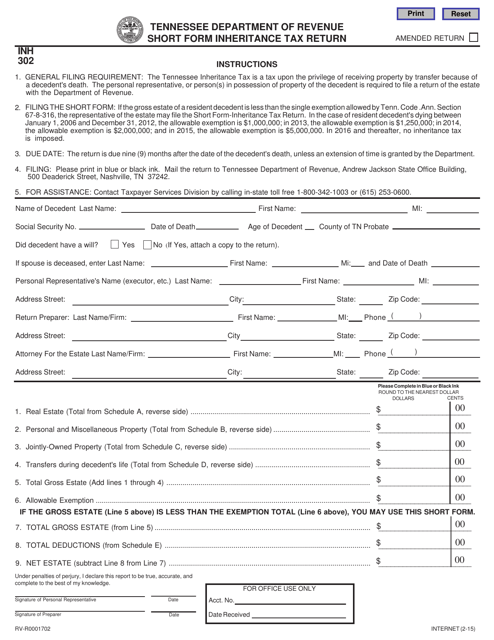

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

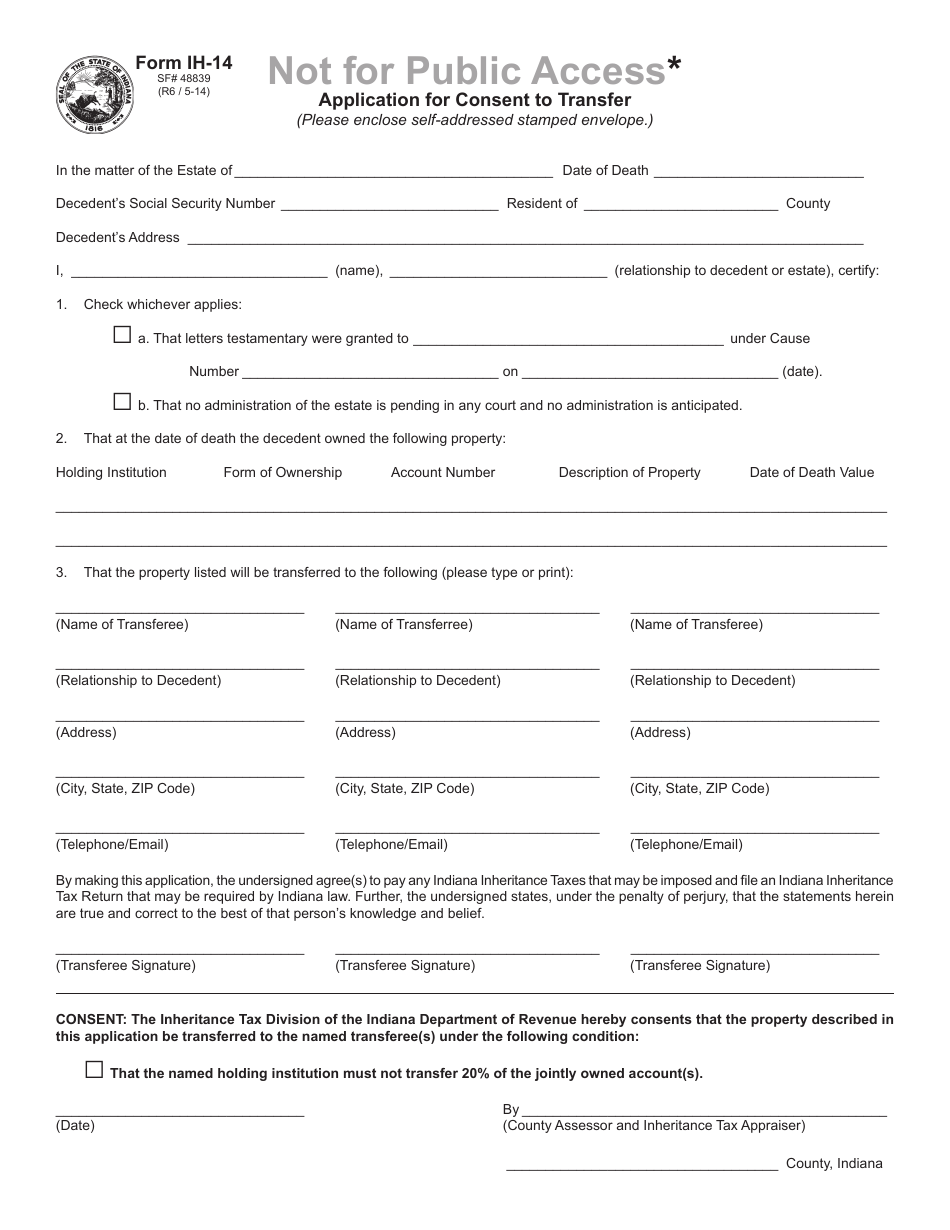

State Form 48839 Ih 14 Download Fillable Pdf Or Fill Online Application For Consent To Transfer Indiana Templateroller

Center For State Tax Policy Tax Foundation

Center For State Tax Policy Tax Foundation

Center For State Tax Policy Tax Foundation