will long term capital gains tax change in 2021

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Its easy to get caught up in choosing investments and forget about the tax consequencesparticularly the capital gains tax.

Pin By Tony Mungiguerra On Leadership Minor Change Management Change Management Models Stock Images Free

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates.

. One crucial change for the tax year 2021 and beyond is that you can claim the EITC as long as your investment income does not exceed 10000. The 20 tax rate was introduced last year and only applies to. Capital gains tax rates on most assets held for a year or.

What was the long-term capital gains tax in 2015. Here are the 2021 long-term capital gains tax rates. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

Below are the short-term capital gains tax rates for 2022 which are a bit different from those for 2021. After all picking the right stock or mutual. Long-term capital gains are incurred on appreciated assets sold after.

Long-term gains still get taxed at rates of 0 15 or 20. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term. The bulk of the population will pay a 15 long-term capital gains tax in 2015.

However there is a tax-free allowance of 12300 for individuals. A long-term capital loss you carry over to the next tax year will reduce that years long-term capital gains before it reduces that years short-term capital gains. The Superior Court of Douglas County Washington recently held that the long-term capital gains LTCG tax on individuals enacted by the state in 2021 violates the uniformity and limitation.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Those with less income dont pay any taxes. They are generally lower than short-term capital gains tax rates.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held.

The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by. This resulted in a 60.

As a business seller if you are in. Tax Rates for Long-Term Capital Gains 2021. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital.

4 rows Additionally the proposal would impose a 3 surtax on modified adjusted gross income over. May 11 2021 800 AM EDT. It appears that the White House is planning to make the effective.

Remember that tax brackets can change slightly from year to year. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. 40401 to to 445850.

Increase in the Long-term Capital Gains Tax Rate. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Bitcoin Investing For Beginners The Latest Info Graphics Cute Girl Bitcoin Hack Investing Bitcoin

Canada Capital Gains Tax Calculator 2021 Nesto Ca

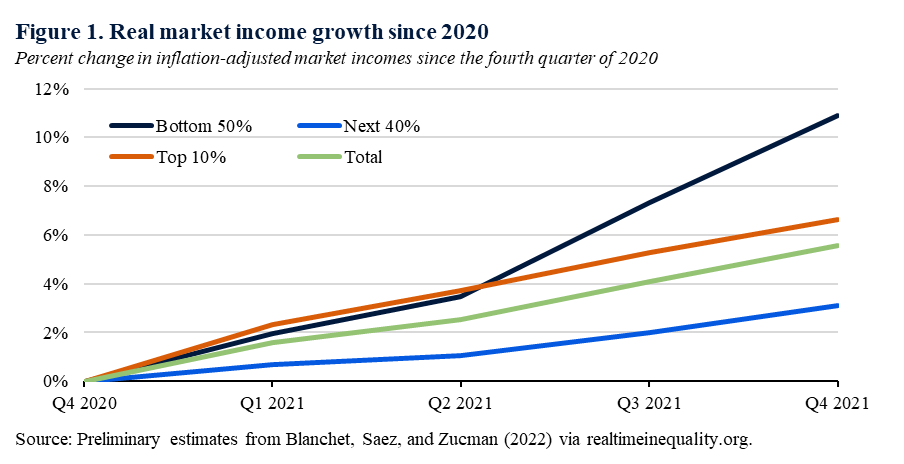

New Data Show That Economic Growth Was Broadly Shared In 2021 The White House

Remi Study Shows Carbon Fee Dividend Grows Economy Paris Agreement Dividend Economic Model

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

Dividend Growth Investor Dividend Aristocrats List For 2021 Dividend Aristocrat Stanley Black And Decker

Pin By Terry Wilson On Wilson Inheritance In 2022 Revocable Living Trust Planning Guide How To Plan

How Tax Rates In Canada Changed In 2022 Loans Canada

How To Make A Year End Planning Checklist Ellevest Financial Coach Wealth Planning Planning Checklist

What Are The Capital Gains Tax Rates For 2020 And 2021 Financial Stocks Stock Market Capital Gains Tax

Dividend Growth Investor Dividend Aristocrats List For 2021 Dividend Aristocrat Stanley Black And Decker

Simple And Easy Tool To Help You Easily Estimate Your Tax Refund Or Tax Payable To The Government Click Here Form12bb Tax Refund Filing Taxes Income Tax